features

faqs

specifications

Saves Time

A fully assembled bedside step stool is convenient in many ways. It saves the extra effort required to understand the different components of the device. But, most importantly, a fully assembled bedside step stool comes with an assurance that it was put together by someone who has complete product knowledge. So, you can sleep peacefully without having to worry about the safety of yourself or your loved one.

Clinically Proven to Help Reduce the Risk of Falls

In a recent study conducted by San Diego State University, researchers concluded that the step2bed helps reduce the risk of falls. Furthermore, it decreases the effort and range-of-motion needed to get out of bed. The step2bed has also been clinically proven to improve stability and increase safety.

Support Bar for Safety

Made of steel and equipped with perpendicular grab bars, the fully assembled bedside step stool ensures full support and can withstand up to 400 lbs. of weight. The handrail has a soft padding that helps the user get a tight and secure grip.

Easy to Use Step

The extra-wide step reduces the risk of tripping or falling. The Velcro straps and anti-slip rubber feet hold the stool in place and decrease the chances of skidding or slipping.

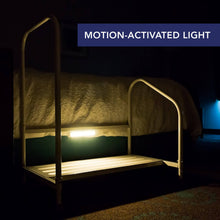

Motion Activated Light

The motion-activated LED light sensor detects human presence within 10 feet and instantly illuminates the floor of the bed step stool. It can light up an area of about 121 sq. ft for about 30 seconds.

Adjustable Height

The floor of the fully assembled bedside step stool can be easily adjusted by as much as 2.5’’ to 7.5’’ to match the height of your bed. It is suitable for both high and low beds.

Safety Bed Rail

A standard safety bed rail is permanently added to the bed but offers no additional features for safety and convenience. The Step2Bed Fully Assembled keeps you secure in bed and also provides a step stool and a perpendicular handrail to help you get in and out of bed safely.

1. What is the Step2Bed made of?

– The Step2Bed is made of steel tubing and metal fixtures.

2. Is the Step2Bed connected to the bed?

– No, it is a free-standing device that sits at the bedside. It is equipped with Velcro straps that secure itself to the bed for stability.

3. Can the Step2Bed go on either side of the bed?

– Yes, the product can be assembled and used on either side of the bed.

4. Can people with knee pain or injury use step2bed?

– Yes, the Step2Bed is useful for people who have knee pain, hip pain, or injury. It can also be used by specially-abled people or individuals recovering from surgery.

5. How much weight does the Step2Bed support?

– The Step2Bed weighs only 20 lbs. and supports up to 400 lbs.

6. What are the advantages of using a fully assembled bedside step stool?

– When you purchase a fully assembled bedside step stool, it helps save time and effort. You don’t need to understand the different components of the device. And you can be assured that it was put together by someone who has complete product knowledge.

6. Can I adjust the height of the Step2Bed?

– The floor of the bed step stool can be easily adjusted (as much as 2.5’’ to 7.5’’) to match the height of your bed. The Step2Bed can be used for both high or low beds.

7. What are the dimensions of the Step2Bed?

– 18" L x 32" W x 32" H.

8. Do you offer same day free shipping?

– We process orders and ship the same day before 12PM EST. We offer same day free shipping anywhere in the continental United States for a minimum order of US$100 (excluding taxes). Orders placed by customers from Alaska and Hawaii will be shipped the same day with a fee of $115. For expedited shipping please call (619) 633-3305

9. Why is Step2Bed the ‘New Bed Rails’ for seniors?

- Catering to the needs of seniors, the Step2Bed Fully Assembled offers much more safety, comfort and convenience as compared to standard bed rails for the elderly. Its unique features include:

- Height-adjustable step

- Tall grab bar

- Extra-wide landing step

- Safe pathway in and out of bed

- Motion-activated LED light

In addition, it comes assembled by a product expert, so you don’t have to worry about quality or the time to set it up.

- Perpendicular handrails

- Motion-activated LED lighting

- Adjustable step height

- Weight: 20 lbs.

- Supports up to 400 lbs.

- Height adjustments from 2.5" - 7.5"

- Made of steel

- Step2Bed Fully Assembled User Manual

features

Saves Time

A fully assembled bedside step stool is convenient in many ways. It saves the extra effort required to understand the different components of the device. But, most importantly, a fully assembled bedside step stool comes with an assurance that it was put together by someone who has complete product knowledge. So, you can sleep peacefully without having to worry about the safety of yourself or your loved one.

Clinically Proven to Help Reduce the Risk of Falls

In a recent study conducted by San Diego State University, researchers concluded that the step2bed helps reduce the risk of falls. Furthermore, it decreases the effort and range-of-motion needed to get out of bed. The step2bed has also been clinically proven to improve stability and increase safety.

Support Bar for Safety

Made of steel and equipped with perpendicular grab bars, the fully assembled bedside step stool ensures full support and can withstand up to 400 lbs. of weight. The handrail has a soft padding that helps the user get a tight and secure grip.

Easy to Use Step

The extra-wide step reduces the risk of tripping or falling. The Velcro straps and anti-slip rubber feet hold the stool in place and decrease the chances of skidding or slipping.

Motion Activated Light

The motion-activated LED light sensor detects human presence within 10 feet and instantly illuminates the floor of the bed step stool. It can light up an area of about 121 sq. ft for about 30 seconds.

Adjustable Height

The floor of the fully assembled bedside step stool can be easily adjusted by as much as 2.5’’ to 7.5’’ to match the height of your bed. It is suitable for both high and low beds.

Safety Bed Rail

A standard safety bed rail is permanently added to the bed but offers no additional features for safety and convenience. The Step2Bed Fully Assembled keeps you secure in bed and also provides a step stool and a perpendicular handrail to help you get in and out of bed safely.

faqs

1. What is the Step2Bed made of?

– The Step2Bed is made of steel tubing and metal fixtures.

2. Is the Step2Bed connected to the bed?

– No, it is a free-standing device that sits at the bedside. It is equipped with Velcro straps that secure itself to the bed for stability.

3. Can the Step2Bed go on either side of the bed?

– Yes, the product can be assembled and used on either side of the bed.

4. Can people with knee pain or injury use step2bed?

– Yes, the Step2Bed is useful for people who have knee pain, hip pain, or injury. It can also be used by specially-abled people or individuals recovering from surgery.

5. How much weight does the Step2Bed support?

– The Step2Bed weighs only 20 lbs. and supports up to 400 lbs.

6. What are the advantages of using a fully assembled bedside step stool?

– When you purchase a fully assembled bedside step stool, it helps save time and effort. You don’t need to understand the different components of the device. And you can be assured that it was put together by someone who has complete product knowledge.

6. Can I adjust the height of the Step2Bed?

– The floor of the bed step stool can be easily adjusted (as much as 2.5’’ to 7.5’’) to match the height of your bed. The Step2Bed can be used for both high or low beds.

7. What are the dimensions of the Step2Bed?

– 18" L x 32" W x 32" H.

8. Do you offer same day free shipping?

– We process orders and ship the same day before 12PM EST. We offer same day free shipping anywhere in the continental United States for a minimum order of US$100 (excluding taxes). Orders placed by customers from Alaska and Hawaii will be shipped the same day with a fee of $115. For expedited shipping please call (619) 633-3305

9. Why is Step2Bed the ‘New Bed Rails’ for seniors?

- Catering to the needs of seniors, the Step2Bed Fully Assembled offers much more safety, comfort and convenience as compared to standard bed rails for the elderly. Its unique features include:

- Height-adjustable step

- Tall grab bar

- Extra-wide landing step

- Safe pathway in and out of bed

- Motion-activated LED light

In addition, it comes assembled by a product expert, so you don’t have to worry about quality or the time to set it up.

specifications

- Perpendicular handrails

- Motion-activated LED lighting

- Adjustable step height

- Weight: 20 lbs.

- Supports up to 400 lbs.

- Height adjustments from 2.5" - 7.5"

- Made of steel

- Step2Bed Fully Assembled User Manual